The Red Flags Consumers Should Watch for When Hiring a REALTOR® by Ken Alger Real Estate

The Red Flags Consumers Should Watch for When Hiring a REALTOR® Buying or selling a home is one of the most significant financial decisions most people will ever make. Yet many consumers don’t realize that not all real estate experiences are created equal—and that some common industry practices

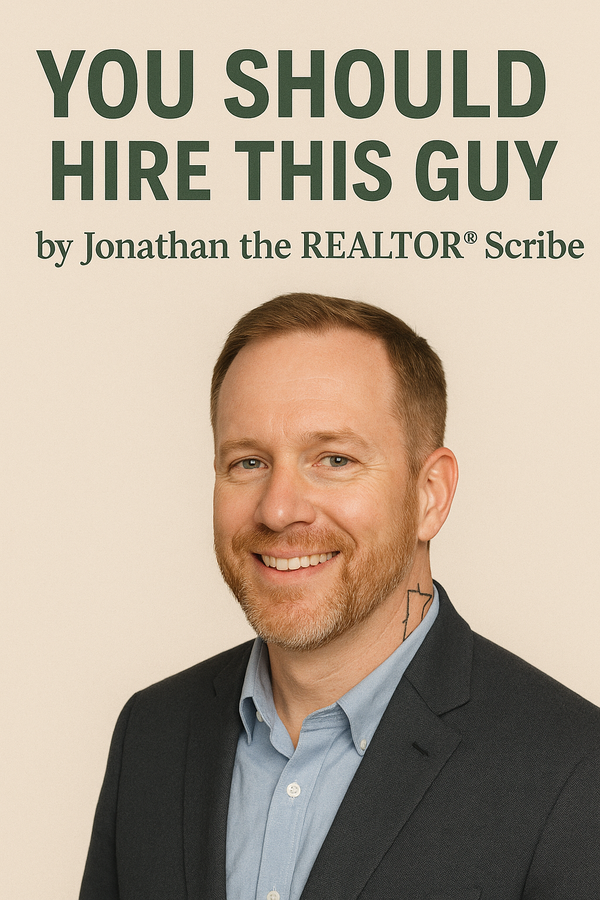

You Should Hire This Guy by Jonathan, the REALTOR®-Scribe

You Should Hire This Guy by Jonathan, the REALTOR®-Scribe If you’re looking for a Minnesota REALTOR® who blends strategy, community advocacy, and that classic Midwest “you betcha, I got you” energy, meet Ken Alger — one of the most trusted real estate guides in the Twin Cities and Greater Minnes

Standing for Community: Why Real Estate Professionals Must Reject Divisive Rhetoric and Champion Inclusive Homeownership in Minnesota - By Ken Alger Real Estate

Standing for Community: Why Real Estate Professionals Must Reject Divisive Rhetoric and Champion Inclusive Homeownership in Minnesota By Ken Alger – REALTOR®, EXIT Realty Springside Minnesota’s housing market is at a crossroads. Rising prices, limited inventory, and widening disparities in homeown

Ken Alger

Phone:+1(612) 434-2477